As a CRNA, your role is critical in patient care. Protecting yourself with the right malpractice insurance is equally important. This blog post will delve into the essentials of malpractice insurance, comparing claims-made and occurrence policies, and emphasizing the importance of carrying your own policy.

Understanding Malpractice Insurance

Malpractice insurance is a professional liability coverage that safeguards healthcare providers from financial loss due to medical errors, negligence claims, or patient injuries. It’s essential for CRNAs as it provides a safety net in case of unforeseen circumstances.

Claims-Made vs. Occurrence Insurance: Which is Best for CRNAs?

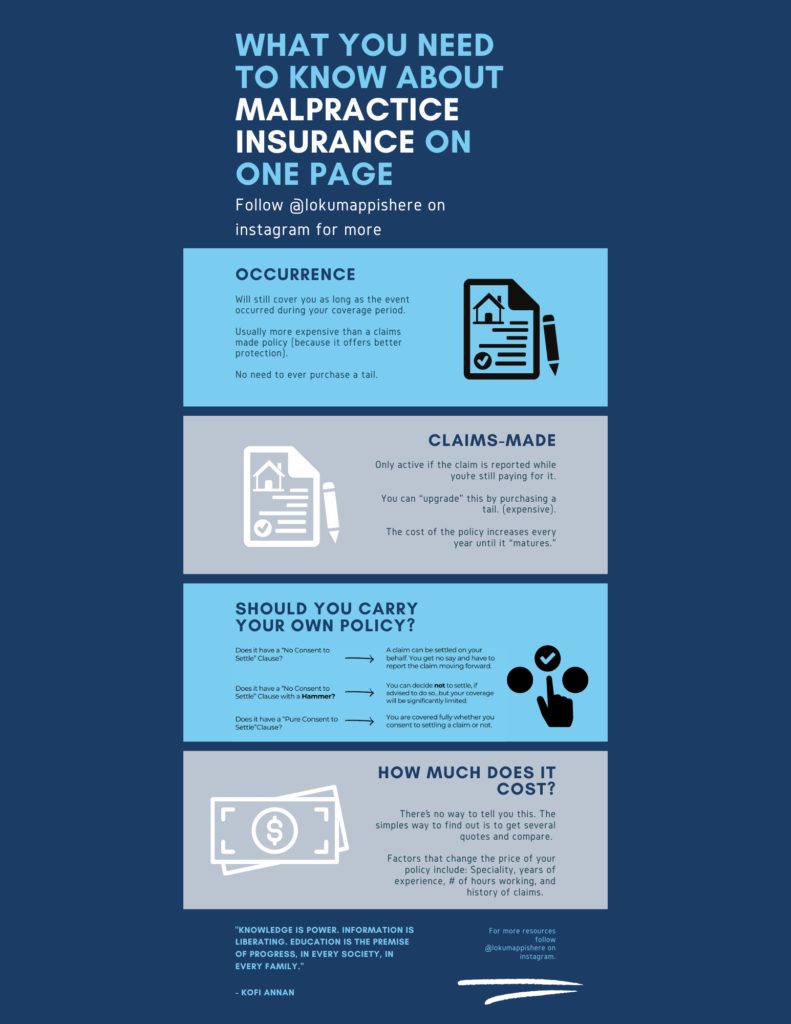

There are two primary types of malpractice insurance: claims-made and occurrence.

- Claims-Made Insurance: This policy covers claims made against you during the policy period, regardless of when the incident occurred. It’s crucial to maintain continuous coverage, as gaps can leave you vulnerable.

- Occurrence Insurance: This policy covers incidents that happen during the policy period, even if the claim is filed after the policy expires. It offers broader protection but is generally more expensive.

For CRNAs, occurrence insurance is often the preferred choice. This is because the nature of anesthesia and potential for delayed complications makes it essential to have coverage in place even after you retire or change jobs.

Why CRNAs Should Carry Their Own Policy

While some facilities may offer malpractice insurance coverage, it’s crucial for CRNAs to maintain their own policy. Here’s why:

- Comprehensive Coverage: Your individual policy ensures you have complete protection, regardless of employment changes.

- Portability: If you decide to switch jobs or go into private practice, your coverage moves with you.

- Peace of Mind: Knowing you have your own insurance can provide significant peace of mind.

- Potential for Higher Limits: Your personal policy may offer higher coverage limits than facility-provided insurance.

Additional Considerations

- Tailored Coverage: Consider policies that offer additional coverages like license defense and personal injury.

- Policy Limits: Ensure your policy limits are adequate to protect your assets.

- Claims History: Your claims history can impact future premiums.

- Regular Review: Review your policy annually to ensure it meets your changing needs.

Remember: This information is a general overview. It’s essential to consult with an insurance professional to determine the best policy for your specific needs. Our CRNA friends at The Incomologists can help!